This is a series of 12 blogs written at the request of CodeQuick to help Medical Practice Administrators optimize the revenue cycle within their practice. Please contact C Business Services if you have any questions or would like more information.

In today’s reality of high deductibles and large patient responsibilities’, patient collections are seen throughout the revenue cycle. When calling to schedule an appointment, patient due balances should be collected while on the phone. Once insurance eligibility is verified, patients should be contacted to notify them of the expectation for them to meet their responsibility at the time of service. At check-in, any uncollected past due balances and co-pays should be collected. Payment at time of service must be an expectation set by the clinic and upheld by staff. Checkout is the time to collect all co-insurance and deduct proportions.

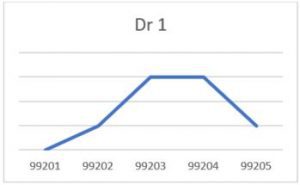

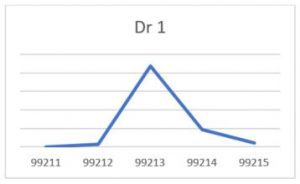

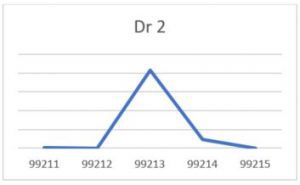

Check-out collections are typically the most difficult for a number of reasons. The first is, naturally, that staff do not know what to collect. Beyond training and utilization of technology to know what a patient insurance coverage, copay, co-insurance, and deductibles are, is the knowledge of the cost of the day’s visit. This knowledge relies on clinic staff and providers getting this information to the checkout team before the patient leaves. If the clinic has not been able to accomplish this a majority of the time, then collection is difficult. One solution, besides allowing patients to leave without any payment, is to estimate an amount owed. The way I suggest clients do this is to review the past year’s appointments and charges for each provider. This combined with the provider’s coding productivity leads to a visual trend and an average charge per visit type.

New Visits:

Follow up E/M visits:

Visit types to review: New Patient; Follow Up; Annual; UTI; Vaccines/Sports

Once this analysis is complete, a cheat sheet can be given to staff for visits at the clinic that allows them to estimate the amount a patient should pay at check-out. The staff then applies the coinsurance calculation or collects the full amount to apply towards the patient’s deductible. This is an educated estimation and patients should be notified as such. One script would be, “Dr. A has not sent through your charges for today’s visit yet. As such, we will need to collect $— which is an estimate of your portion of today’s visit based on the average charges for this type of visit. Your visit total may be more or less and we’ll reconcile after billing your insurance.”

Cheat Sheet example:

| Visit Type | Charges | Amounts | Total Due |

| New Patient (all providers) | 99203, no addt’l labs/tests | $350 | $350 |

| Follow up (all providers) | 99213, no addt’l labs/tests | $225 | $225 |

| UTI | 99212, 81002 | $140 + $30 | $170 |

| Annual, Vaccines, Sports – Preventative Visits | Preventative codes, no addt’l labs/tests | Covered by ins, collect copay | Copay only |

If you have a PCI compliant system, another solution is to put a credit card on file. This assures that when charges are not immediately available at checkout, payment will still be made. This can also be used after insurance has been billed. However, a note of caution about holding credit card information and credit card processing. According to a 2016 MGMA Stat poll, only 20% of clinics are holding credit cards on file. Clinics should be aware of Red Flag Rules and assure any credit card processing follows PCI rules if they decide to use this method. It is best if all credit card information is stored by a third party and never on site. Clinic staff should never write a credit card number down, whether on a sticky note or on an official form. This information is highly protected by regulations and puts the clinic at risk.

After a patient walks out of the clinic, the chance of collecting any money owed drops drastically. Some estimate the percentage drops as low as 20% to collect. One way to help increase this percentage is to make it easier for patients to pay their bills. Paying bills online is a common occurrence for everything from utilities to car loans. Clinics should have online bill pay available as well. This feature should not, however, be hidden behind secure logins for a patient portal. If a patient’s spouse, parent, or dependent want to pay their bill, it should be easy to do so. What does the clinic care who is paying the bill as long as it is paid? Always remember the KISS principle.

Another way to make it easier for patients to pay their bills is to allow them to make incremental payments. Payment plans make a large bill easier to swallow. Many RCM companies, including BillingTree, suggest payment plans for specialty medical practice that expect higher bills for their patients. Radiology, surgery, and other specialties know that patients will be stuck with a larger bill than say, family practice. It is suggested that allowing patients to start payment plans before the date of service and limiting the payment plans to a set range (3-6 months) give the patient the ability to control their expenses and the clinic to assure that the payments will be made. Otherwise, the clinic is taking a gamble that the patient will have the large amount all at one time. Which, according to a 2016 Kaiser Family Foundation/New York Times survey, is unlikely. This also cycles back to the insurance verification step, once known what the patient’s responsibility is known, communicating with the patient, and offering them this option is not just amazing customer service (Bonus points!) but helps solidify the revenue cycle for the clinic.

Information regarding paying bills online and how to contact the clinic for billing assistance should be on the clinic’s website and statements. How many statements should the clinic send out? How much time/energy does the clinic have waste? Most clinics send out 3 statements. Most financial consultants suggest sending out only two. Personally, I suggest sending out as many statements, letters, and/or calls as make sense to your clinic. However, when the balance hits 120 days it must go to collections. The clinic’s collection team must move on and stop wasting time on this account. According to a 2017 MGMA Stat survey, most clinics send accounts to collections BEFORE 120 days. Administrators and managers should have a policy regarding Bad Debt vs Collection write-offs and stick to it. (See this article regarding the cost of sending statements.)

Collection agencies have the time and resources to track patients down, the clinic’s team does not. This time can be better spent on more current account with a large probability of collection. To be sure, sending an account to a collection agency is essentially writing off 20-50% of the amount of that account. Though, if the clinic has done all of the items suggested in the other 11 sections of this series, then the amount of the accounts sent to collections should be a small percentage comparatively. Therefore, the percentage is worth it. As with any vendor selection, administrators should put forth their due diligence to assure that the agency selected is the best for the clinic. The amount spent should reflect what the clinic is getting in return, not just collection of accounts, but reporting and additional add-ons and assistance and training for in-office collections. A clinic’s collection agent should be a partner, not just an outside entity. When contacting patients, they are still a reflection of your clinic, they must reflect the clinic’s values. The patients sent to collections may come back to the clinic and will still have relationships with others in the community that come to the clinic. This is a good article about what to look for.

As with any cycle, the beginning is the end and returns to the start. With high patient deductibles, patient collections are not just the beginning or the end of the story but are found throughout the entirety of it. All staff should be trained on how to talk to patients about money and finances. This training should include providers. If administrators naïvely think that their providers do not already talk to patients about their bills and how much they should pay the clinic or what their insurance pays, they only have to ask the billing, clinical, or check-out staff. Patients are often quoted as saying “Dr. B said I didn’t have to pay that.” Training providers to have a script of “any insurance or billing questions will have to be answered by —-, I am just here to provide you medical care,” is a great way to avoid any potential billing and financial arguments with patients.

If you have any questions or need assistance with your revenue cycle, feel free to reach out to C Business Services, CodeQuick, or one of your local associations: